Tax and legal advice

Comprehensive tax and legal advice for tax-efficient business and transactions

How can we help?

We specialize in tax and legal advice; tax is our flagship area of expertise. Tax advice is the core of most of our legal advice. This gives our clients qualitative comfort and, thanks to synergies (our one-stop shop), saves consultancy costs.

We add situational tax and legal advice to all our business conferences, including the largest legal and tax conference in Slovakia, which we had the privilege of organizing. We frequently offer opinions on this topic in the media, publish articles, give lectures, and organize training sessions and webinars.

Tax and legal advisory services are the backbone of our consultancy revenues. Our offer ranges from simple tax advice on real estate, financial instruments, or crypto assets, through the setup of ESOP plans and the sale of companies from the tax and legal standpoints, to complex tax-legal advice on debt securitization, large-scale loan transactions, or investment funds.

We have had continued success at the Slovak “Law Firm of the Year” awards, being recognized as a highly recommended tax law firm for 2020, 2021, and 2022. We link consultancy with accounting, thus creating a unique advisory unit in Slovakia that retains a boutique quality.

Examples of our tax and tax law consulting service areas:

- Taxation of real estate, business shares, stock, and other capital income;

- Transactional advice (asset sales, investor entry, or securities issuance);

- ESOPs and Employee Stock Ownership;

- Advice on international tax structure creation and ownership protection (e.g., trust structures and trust funds);

- Analysis of existing international structures for compliance with applicable Slovak and international law;

- Assessment, in light of common practice, of an existing optimization scheme vis-a-vis potential tax and criminal risks.

Taxes and criminal liability

Under Slovak tax law, not every illegal tax optimization qualifies as a tax offence. As with the identification of what is and what is not lawful in minimizing tax or contribution liability, the line between criminal and administrative law (Tax Optimization – Domestic and Foreign Options) in regards to tax offences is vague.

Text from the slide:

Unfortunately, Slovak tax law does not have extensive clarifying case law, where courts or prosecutors might focus on delineating more precise boundaries. From a business point of view, it is not at all comfortable to be unable to foresee the penalty for a tax offence committed. In this context, imprisonment (in conjunction with the penalty of asset forfeiture) is indeed the most serious potential personal risk.

A majority of Slovak entrepreneurs can relate to the case of Andrej Kiska’s KTAG. From the rule of law perspective, it is unproblematic that the he was charged with tax evasion and insurance fraud. Rather more troubling is that previous tax administrators and law enforcement authorities had never before indicated the accused conduct exceeded the criminal threshold. This second point impacts a huge number of entrepreneurs who potentially may be exposed to the prospective arbitrariness of the State which seeks to criminalize heretofore acceptable conduct.

Our services

We provide comprehensive services in the field of tax consulting and tax optimization (Tax optimization – Domestic and Foreign Options). In addition to technical advice, this also includes legal analysis with an emphasis on analysis of likely criminal risks.

Clients typically use our services in the following situations:

- transactional advice, which also includes tax advice;

- when assessing an existing tax and legal structure;

- when setting up a client's business with an emphasis on tax – contribution efficiency;

- when representing a client before the tax authorities or courts.

Practical examples – Case studies

Case 1: A company makes a profit. However, it does not pay the profit to the shareholder as a dividend, but instead gifts it to the shareholder, thus avoiding dividend taxation. Slovak legislation does not formally prohibit this. It can be regarded as:

- legal tax optimization (avoiding taxes on dividends);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 2: A well-known athlete moves to Monaco and becomes a Monegasque tax resident. However, he spends a large part of the year in Slovakia at various marketing events, staying over in his Bratislava apartment or hotels. If he does not tax his worldwide income in Slovakia, it is:

- legal tax optimization (avoiding Slovak taxes);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 3: An entrepreneur purchased a family car from which she deducted 100 % VAT and treats 100 % of the car depreciation as a taxable expense. However, she uses the vehicle exclusively for family transfers. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 4: An entrepreneur owns two companies. Before the end of the calendar year, the preliminary results showed that one company was expected to make a profit of €1 000 and the other a loss of €500. Therefore, the entrepreneur decides to invoice €400 from the loss-making company to the profitable company for marketing services, thus reducing tax liability. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 5: An entrepreneur set up a company on a Caribbean Island with a 0% tax rate, and from which she invoices her IT services to Slovak clients. However, the entrepreneur is mainly based in Slovakia when performing the services. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

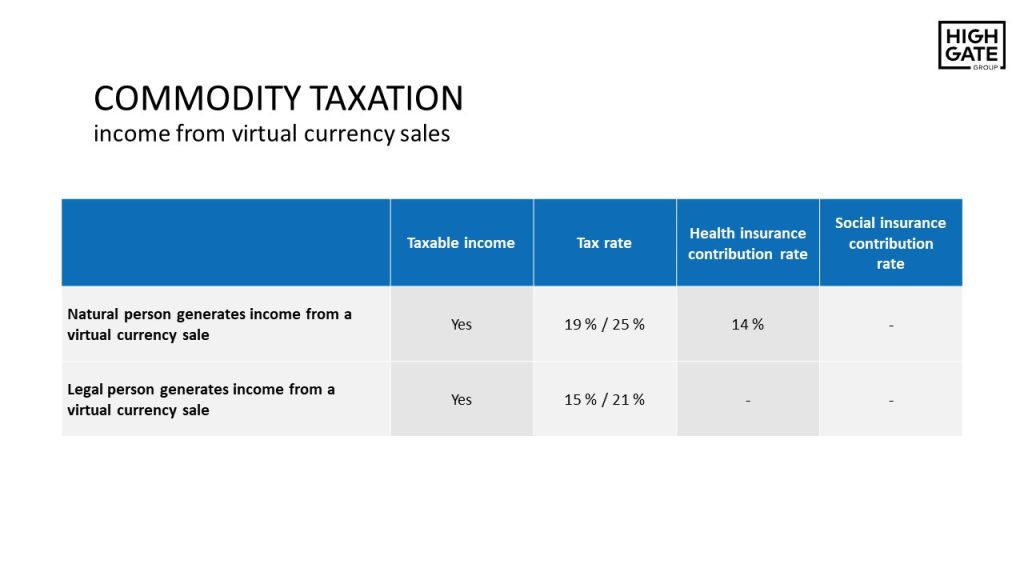

Cryptocurrency taxation

The value of cryptocurrencies is rising and so is the demand for tax and legal advice on cryptocurrency taxation and legal avenues for reducing tax and contribution liability.

In the basic setup, Slovak tax and contribution residents have their profits from the cryptocurrency sales taxed at a tax rate of 19% or 25%. This profit is simultaneously subject to health insurance contributions. Legal persons´ tax base is at a 15% or 21% tax rate. However, despite these relatively clear rules, cryptocurrencies are, in practice, a very complex tax and accounting topic.

A selection of the areas we deal with:

- what is deemed a tax expense when trading cryptocurrencies;

- review of trading via different platforms;

- how are non-monetary deposits (home or abroad) by individuals or legal entities assessed;

- the use of foreign companies in cryptocurrency trading;

- what to do if the taxpayer cannot accurately calculate the tax base;

- the acquisition value of cryptocurrencies in donations, deposits, mergers or liquidations;

- cryptocurrencies and VAT (cryptocurrencies are not necessarily outside the VAT regime).

Visit the Highgate Group website to learn more on cryptocurrency taxation from our articles and videos.

Our cryptocurrency taxation services:

- analysis of legal tax and/or contribution optimization options;

- implementation of foreign solutions;

- representation in tax proceedings;

- analysis of the limits of criminal liability in the context of specific cases.

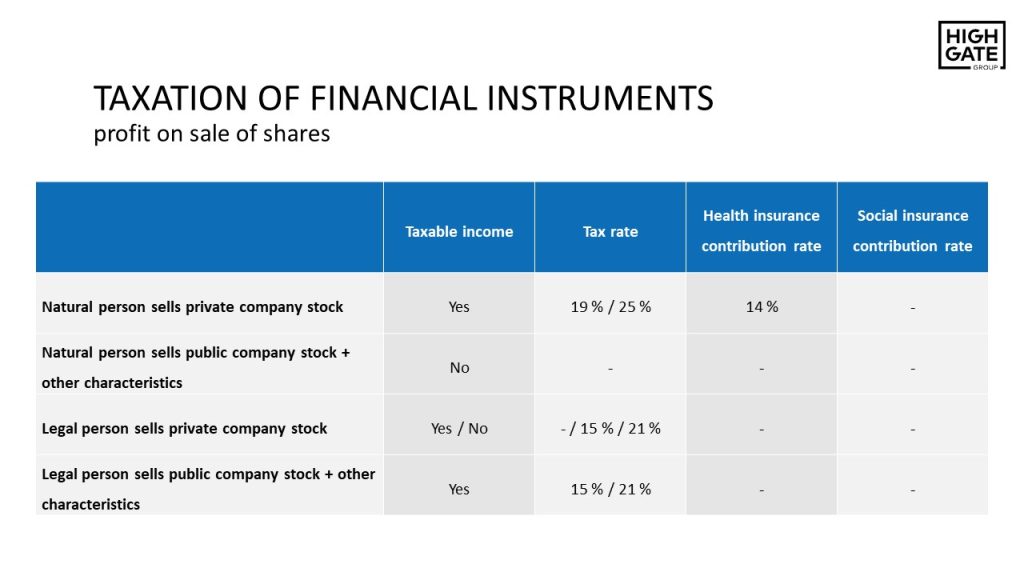

Financial instruments include, in addition to securities, derivatives, holdings in collective investment undertakings, contracts for difference (CFDs) and, in some cases, cryptocurrencies.

The taxation and contribution requirements of financial instruments are not harmonized. Thus, the specific tax rate and, where applicable, the obligation to pay compulsory social or health insurance depend on the financial instrument and type of income the individual accrues in connection with it.

Taxation is somewhat simpler for legal persons. However, the accounting is significantly more difficult, especially for derivatives and derivative cryptocurrencies.

It is important to note that accounting and taxation of more complex financial instruments and cryptocurrencies are generally not harmonized in the European Union. Member States develop their own tax and accounting frameworks.

This has implications, especially for smaller countries such as Slovakia, which naturally do not have the capacity to comprehensively address such topics.

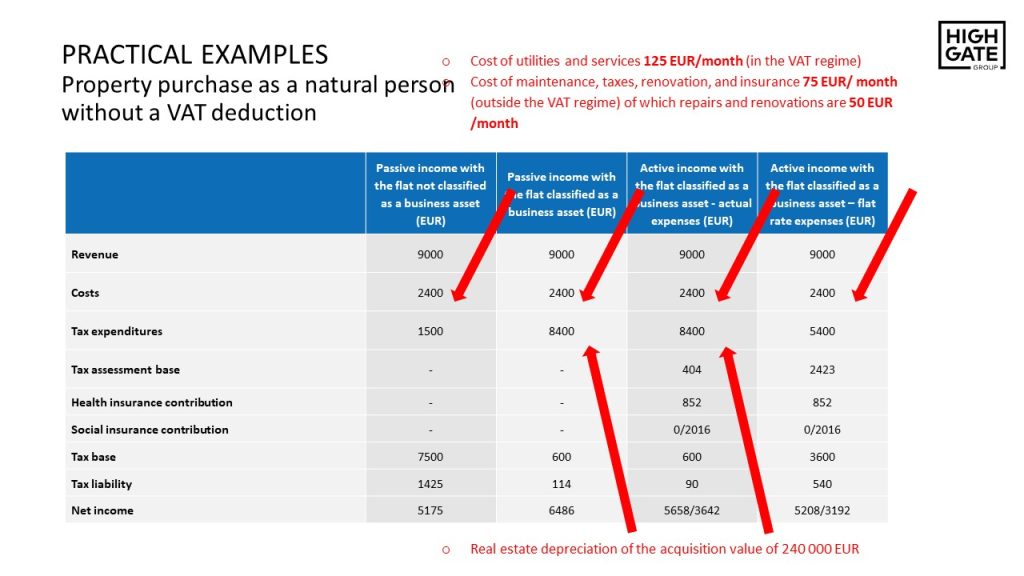

In addition to income tax and contributions, VAT also plays a prominent role in real estate taxation. This topic is of interest to real estate entrepreneurs as well as natural persons not currently engaged in business, who use real estate as a means of appreciating their assets.

Frequently, in cases of natural persons buying investment properties, our clients are particularly interested in these topics:

- when is the VAT deductible on the purchase of real estate;

- is it better to rent the property through an LLC or as a natural person;

- entrepreneur/non-entrepreneur and taxable/non-taxable persons;

- when is dealing in real estate deemed a business;

- if purchasing the property without VAT, it is possible to obtain a VAT deduction when it is subsequently sold VAT inclusive;

- is it possible to sell the property VAT exclusive if it has been purchased VAT inclusive.

We advise clients on structuring their real estate business. This is not only the case with our larger development projects at Highgate Group – natural persons as individual (and smaller) investors also find added value in our advice.

Employee stock in Slovakia

We handle employee stock and the entire ESOP process comprehensively through the legal (we propose and draft the ESOP rules), accounting, and tax lens. Thus, clients get an all-inclusive service, including:

- drafting of ESOP agreements;

- drafting of "drawer agreements";

- tax and contribution assessment and design of ESOP structures;

- advice on risk-minimization in the event of a tax audit;

- corporate change enactment;

- ESOP structure establishment using a foreign company.

We have long been involved in the field, providing services and organizing conferences and online training sessions. And since we are still a young company, ESOPs are also of practical interest to us.

In Slovakia, the moment of taxation is the principal ESOP structure-related problem. The present Income Tax Act presumes the generation of a non-cash income and taxation from when the employee acquires the stock. In the case of option plans, this moment might occur sooner.

This concept contradicts the fundamental principle of taxation based on the taxpayer’s ‘ability to pay’. In other words, the acquisition of employee shares is supposed to be taxed at a point in time when neither the employer nor the employee has cash income to be used to pay the tax and contributions.

In some situations, an entrepreneur might look for ways to avoid this moment of taxation. We look for legal ways to set up an ESOP structure on a case-by-case basis to delay the moment of taxation until the actual receipt of cash income, reduce the tax and contribution rate, and minimize the risks in case of a tax audit. Finding a legal and tax-efficient structure is the key to the ESOP framework use.

Otherwise, an entrepreneur is presented with two options:

- avoid using the ESOP structure; or

- create an ESOP structure in a fiscally unsound manner (i.e., illegally).

“Employing” contractors is common in startups. Not only may this be an abusive practice in line with the “Schwarz system” – false self-employment (Labor Law & “Schwarz system”), it may also have negative tax and contribution implications from the point of view of “ESOP taxation”. This stems from the philosophical premise that a taxpayer’s income should be subsumed into the category of activities affected by that income. Thus, in critical situations, the contractor´s acquisition of stock in a company may result in income tax imposition and deduction of health and social insurance arrears in the annual settlement.

The ESOP structure´s ultimate tax and contribution impact depends on several factors:

- The form of cooperation between the contractor and the company providing/brokering the company shares;

- the level of the contractor´s involvement in the company;

- the contractor's occupation outside the company;

- the real value of the company or its current stage of development.

It is relatively common to see the issuance of tokens as a “stake”, representing some value of the platform or company where the employee or contractor is professionally engaged.

These are not just security tokens, but also utility tokens or some derivative thereof, which attracts the potential of future capital income.

The tax and contribution implications of these arrangements depend on the ESOP structure´s setup, i.e., the issuance of tokens and their fate (e.g., disposition on the secondary market) may also be replicated by a subsequent legal “offline” regime. In that case, the tax and contribution regime mirrors that applied in the parallel, legal “offline” world.

There may be a structure where a company issues tokens backed by “phantom” agreements and the income from holding the tokens thus follows the same tax and contribution regime as detailed in the relevant contracts. This does not have to be affected by the tokens´ liquidity on the secondary market.

Cryptocurrencies have introduced a new diversity to the legal and tax world and our role as legal, tax, and accounting advisors is to attach relevant and appropriate legal, tax, and contribution effects to this phenomenon.

A company often first grants or sells stock options to its employees. Then, having met specified conditions, the employee can “convert” the stock option into a real share in the company. There are various derivatives of this:

- selling a stock option to an employee for a nominal price;

- granting a stock option to an employee free of charge;

- selling/granting a stock option to an employee by a foreign company;

- selling/granting a stock option to an employee´s company by a Slovak or foreign company;

- selling/granting a stock option to a contractor - a natural person- by a Slovak or foreign company;

- selling/granting a stock option to a contractor – a legal person - by a Slovak or foreign company;

- selling/granting an ESOP option to a company associating employees and/or contractors by a Slovak or foreign company;

- foreign employees/contractors;

- the moment (options) of share acquisition.

Since our income tax law does not set out rules identifying the tax and contribution frameworks for these types of ESOP structures, we look for analogies in foreign legislation and draw on relevant case law and philosophical concepts in tax law when analyzing the ESOP structures´ tax implications.

The vagaries of the tax and contribution treatment of employee stock ownership is compounded by legal complexity. In several ESOP structures, we deal with a variety of “bad leaver” situations that require a more sophisticated legal and practical approach. This element needs to be attached relevant tax and contribution implications. It is necessary to bear in mind the ever-warped decision-making practice in Slovakia. On the one hand, it is a somewhat protective role of judges in employment disputes that disadvantages employers, on the other, it is time and cost elements.

Therefore, it is necessary to prepare for “bad leaver” situations preemptively in a clear, straightforward, and practically enforceable language and manner.

Examples of employee stock

For more information on employee stock and case studies visit the Highgate Group webpage.

Our services in the field of employment of "contractors"

We provide:

- financial analysis of the impact of employing "contractors";

- comparison of LLC with trade license for client's contractors;

- analysis of the impact on social insurance benefits for specific natural persons;

- analysis of the limits and possibilities of employing "contractors" in light of current case law with regard to the "Schwarz system";

- drafting of cooperation agreements with regard to:

- the elimination of risks associated with the "Schwarz system";

- protecting the company from "bad leaver" situations;

- protecting IP and other company assets.

Labor law at Highgate Group

Highgate Group is a tax and accounting firm and a law firm. Our clients can meet a payroll accountant or a labor lawyer here. We are confident that this concept adds value for our clients and colleagues alike.

It also places clients – as recipients of payroll accounting services – in a more comfortable position. We are aware that other accountants often gather legal knowledge and awareness by searching the Internet. Such information may be misinterpreted and outdated.

Templates of legal documents

Our clients are welcome to use a range of free legal document templates prepared by Highgate Group, including employment contracts, termination agreements, cooperation agreements, and more.

This is an important topic, given the significant difference between standard employment and employment of a trade license holder (self-employed person). We address this situation from the tax, contribution, and legal perspectives, including with an eye to social insurance benefits.

An employee´s gross salary is 2000 EUR. He agrees to obtain a trade license and invoice the employer 2000 EUR for his work.

If:

- the employee has one dependent/ minor under the age of 6 for whom he claims a tax bonus;

- he does not claim any other tax bonus;

- he does not claim the non-taxable part of the tax base for a spouse nor any other non-taxable part except that under §11(2) of the Income Tax Act;

- as a self-employed person, he claims flat-rate expenses;

- as a self-employed person, he is subject to an annual social insurance settlement;

- as a self-employed person, he does not pay unemployment insurance;

- the employer has a positive tax base;

- the employer is subject to a 21 % tax rate.

What are the tax and contribution implications for both legal forms? The figures reflect the tax and contribution rates in force in the second half of 2021.

| EMPLOYEE | SELF-EMPLOYED | |

|---|---|---|

| Gross salary | 2 000 EUR | – |

| Employer cost | 2 704 EUR | 2 000 EUR |

| Health insurance contribution | 268 EUR | 76 EUR |

| Social insurance contribution | 704 EUR | 181 EUR |

| Income tax | 211 EUR | 15 EUR |

| Net total | 1 521 EUR | 1 728 EUR |

| Employer's tax shield | 568 EUR | 420 EUR |

| Employer cost | 2 136 EUR | 1 580 EUR |

The financial differences between the two are significant for both the employer and the “employee”. Nevertheless, should the employee, as a self-employed person, be in the ‘contribution holiday’ regime, the financial difference would be even more significant:

| EMPLOYEE | SELF-EMPLOYED | |

|---|---|---|

| Gross salary | 2 000 EUR | – |

| Employer cost | 2 704 EUR | 2 000 EUR |

| Health insurance contribution | 268 EUR | 76 EUR |

| Social insurance contribution | 704 EUR | 0 EUR |

| Income tax | 211 EUR | 52 EUR |

| Net total | 1 521 EUR | 1 872 EUR |

| Employer's tax shield | 568 EUR | 420 EUR |

| Employer cost | 2 136 EUR | 1 580 EUR |

It is a whole new tax-contribution ball game if the contractor cooperates with the company by means of his own legal entity. Two other aspects come into play then that can significantly affect the resulting savings figure.

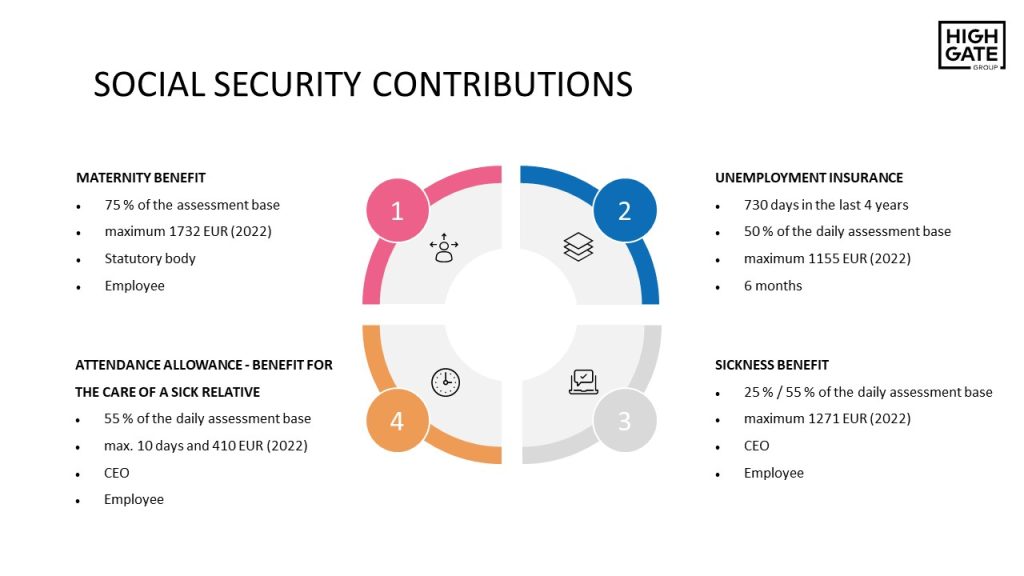

The advantages of self-employment cannot be viewed in isolation through the lens of the two tables only. Completing the picture is the impact on social insurance benefits, the amount of which varies depending on circumstances, including the legal form of the natural person´s economic activity.

The social security benefits situation is also different for contractors who provide their services by means of a legal entity.

Self-employment & Maternity leave

Maternity benefit entitlement is conditioned upon the continuance of sickness insurance for a minimum of 270 days in the last two years prior to childbirth. Should a self-employed person be in the contribution holiday regime and not pay social security contributions as a voluntarily insured person, they may not be entitled to a maternity benefit. The maternity benefit is equal to 75% of the daily assessment base. The daily assessment base is derived from the average of the assessment bases in the reference period. The reference period varies from case to case. To simplify, the amount of maternity benefit for a self-employed person depends on how much and when the self-employed person contributed to social insurance/security.

However, it is with maternity benefits that the Social Insurance Act allows for methods of self-employed persons receiving the maximum maternity benefit. The maximum amount of maternity benefit (31-day months) is gradually approaching 2 000 EUR. For more information, arrange a personal consultation with Peter Varga. Our accounting clients enjoy a 50% discount.

Self-employment & Sick leave

Self-employed persons may be found unfit for work in the event of illness, accident, or quarantine. The standard amount of sick leave benefit depends on individual social insurance contributions and the type of sick leave (the amount may be different for pandemic related sick leave).

If the self-employed person qualifies for a sick leave benefit (as a social security contributor or if in the “protection period”), the amount of the benefit is comparable with that for employees:

- 25 % of the daily assessment base from the 1st to the 3rd day of work absence;

- 55 % of the daily assessment base from the 4th day of work absence.

The daily assessment base depends on several factors. The self-employed who use flat-rate expenses enjoy a lower assessment base for social insurance contributions. This also impacts the daily assessment base. Note that a self-employed person cannot estimate the amount of benefit in advance as accurately as in the case of a maternity benefit.

Self-employment & Attendance allowance

An attendance allowance became a prominent social supplement during the pandemic and school closures. It helped employees, the self-employed, and employers alike overcome pandemic period cash-flow difficulties.

The self-employed are entitled to an attendance allowance provided they pay social security contributions or are in the protection period. The attendance allowance amount depends on the daily assessment base. It is derived from the contributions the self-employed person made to the social security system in the ‘reference period’. The amount of the attendance allowance is 55 % of the daily assessment base. Thus, like the sickness benefit, the amount of the attendance allowance for the self-employed is influenced by the lower contribution obligation as compared to employees.

Self-employment & Pension

Although pensions are an abstract topic for many of our clients’ contractors, some are interested in analyzing the effects of conversion to self-employment on future pensions. The merit principle applies to pensions – the more one contributes to the social system, the higher the pension. However, a social element plays a role here – pension ceilings, the coefficient for higher pensions, as well as the minimum pension system.

For example, if the conversion from employment to self-employment involves a drop in monthly pension of 200 EUR, it adds up to 36 000 EUR in 15 years. That is a significant amount. We help our clients analyze this aspect, too.

Self-employment & Unemployment insurance

A self-employed person is entitled to unemployment insurance only if they have paid voluntary contributions to unemployment insurance for at least two years in the 4 years preceding their inclusion in the Jobseekers Register. The self-employed only fulfil the benefit eligibility criteria if they have paid contributions to voluntary unemployment insurance.

The unemployment benefit amounts to 50 % of the daily assessment base, which is derived from the average of the assessment bases in the reference period.

The reference period for determining the daily assessment base is different here than for maternity or sickness benefits. It is the two-year period preceding the date on which the unemployment benefit was due.

It is not. In addition to an administrative sanction, using the Schwarz system may qualify as a tax offence (in particular, tax evasion and insurance fraud). When establishing relations with contractors or converting employees to contractors, it is essential to approach this action as a project deserving legal consideration and attention. The goal is not only to minimize the risks of government sanctions, but also set up contractual relationships with contractors in such a way that the company is protected (e.g., IP rights).

Case law is not uniform. Inspiration is to be found in the Czech case law, which coined the term “Schwarz system”, and produced an extensive collection of court decisions. We use these to set up defensible legal, tax and contribution frameworks for the employment of self-employed persons (sole proprietors – trade license holders). It is a whole new tax and contribution ballgame if the contractor works with the company by means of an independent legal entity.

OUR COURSES AND TRAINING

- How can I (efficiently) tax income from securities, derivatives, or cryptocurrencies? Can I avoid taxation altogether?

- Want to get paid through the company, legally and tax-efficiently, as a partner? There are multiple options.

- Is it better to buy an apartment/chalet/securities as a natural or legal person?

- Is a trade license or LLC better for me? What about social insurance contributions? Can I, as a self-employed person, invoice my own company?

- Scaling business abroad, using offshore companies. Can I pay 0% tax abroad?

- How can I prepare a company for a sale or investor entry?

- What are the available and effective options for external Company financing?

- How can I negotiate a good term sheet with an investor?

- What should I watch out for when preparing a shareholders' agreement?

- What are the shareholder dispute resolution options?

- What are the options and advantages of different forms of employee stocks and shares (ESOPs)?

Law & Tax

Tomáš Demo

tomas.demo@hgold.amcef.com

Accounting

Peter Šopinec

peter.sopinec@hgold.amcef.com

Crypto

Peter Varga

peter.varga@hgold.amcef.com